Financing/Home Loan Process Explained

Pre-Qualification

Pre-qualification starts the loan process. Once a lender has gathered information about a borrower's income and debts, a determination can be made as to how much the borrower can pay for a house. Since different loan programs can cause different valuations a borrower should get pre-qualified for each loan type the borrower may qualify for.

It is important to remember that there are no rules carved in stone. Each applicant is handled on a case-by-case basis. So even if you come up a little short in one area, your stronger point could make up for the weak one.

Mortgage Programs and Rates

In order to properly analyze a mortgage program, the borrower needs to think about how long he plans to keep the loan. If you plan to sell the house in a few years, an adjustable or balloon loan may make more sense. If you plan to keep the house for a longer period, a fixed loan may be more suitable.

With so many programs from which to choose, each with different rates, points, and fees, shopping for a loan can be time-consuming and frustrating. An experienced mortgage professional can evaluate a borrower's situation and recommend the most suitable mortgage program, thus allowing the borrower to make an informed decision.

Summation

A typical mortgage transaction takes between 14-21 business days to complete. With new automated underwriting, this process speeds up greatly. Contact one of our experienced Loan Officers today to discuss your particular mortgage needs!

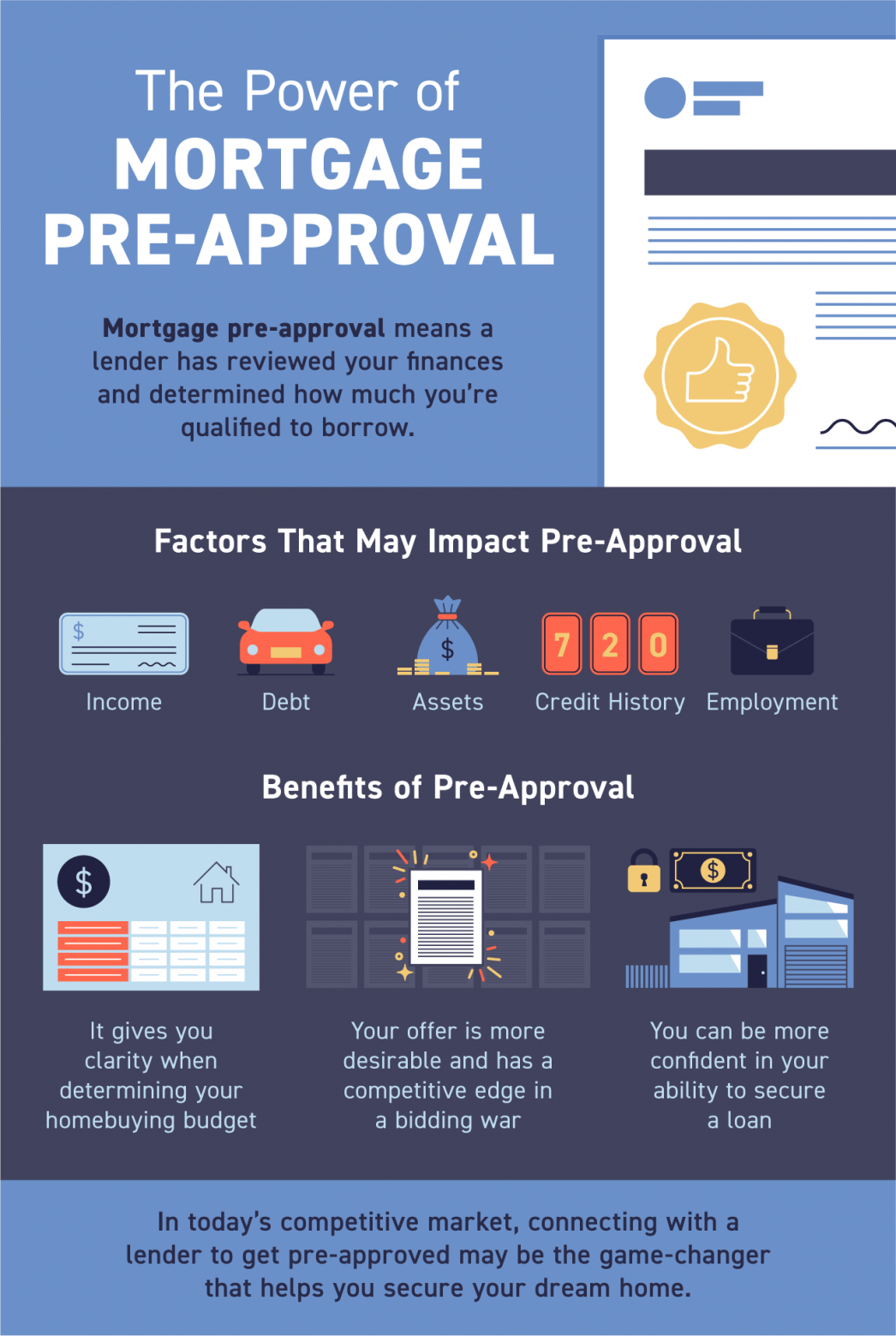

- Mortgage pre-approval means a lender has reviewed your finances and, based on factors like your income, debt, and credit history, determined how much you’re qualified to borrow.

- Being pre-approved for a loan can give you clarity while planning your homebuying budget, confidence in your ability to secure a loan, and a competitive edge in a bidding war.

- In today’s market, connecting with a lender to get pre-approved may be the game-changer that helps you secure your dream home.

Independent Mortgage Professional

- Licensed mortgage expert

- Specializes in mortgage only

- Partners with SEVERAL lenders to offer multiple loan products, allowing you to choose the best option

- Often offers lower rates and cheaper costs due to less overhead

- Adapts to industry changes quickly

Bank

- Not required to be licensed and are not held to the same standards and regulations as brokers in terms of testing and ongoing training

- Offer many other loan products (auto, boat, etc.), so mortgages are not their main focus

- Only able to offer limited loan products they have in-house, which may not be the best fit for your needs

- Offer higher rates

- Slower to adapt to changes due to large organizational operations